By Thomas Gehlen, Senior Market Strategist, SG Kleinwort Hambros Bank Limited Gibraltar Branch

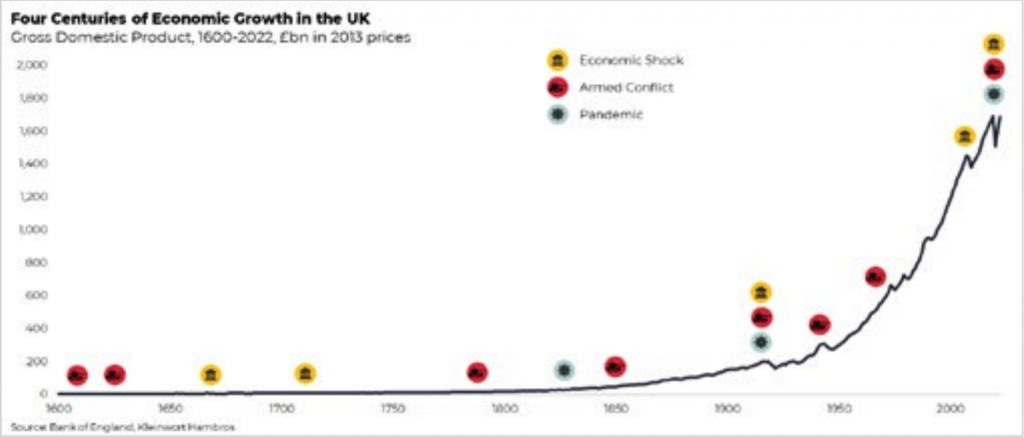

It’s all been a bit much. In quick succession, a pandemic, an armed conflict, and a banking crisis upended life as we know it. Demand shifted, inflation ensued, and central banks sprang into action. Now, more than two years after the first-rate hike, central banks have finally reached their peak. Tighter monetary policy will undoubtedly weigh on economic growth, although any resilient economy should adapt to it. It’s not the pandemic, war, or banking failures shutting it down either – countless such events occurred since reliable records began some 400 years ago. More fundamentally, two of the main drivers of economic expansion – population growth and labour productivity – are now beginning to stagnate.

Once upon a time

The banking failures in March raised uncomfortable memories of the great financial crisis of 2008. But lenders have failed much earlier than that. In 1672, King Charles II effectively defaulted on debts racked up over years of waging war in France. The dire economic consequences of the resulting collapse of goldsmith bankers led to the founding of the Bank of England to support the management of public finances going forward.

In the 350 years since, the United Kingdom never defaulted on its debt again. Meanwhile, inflation has been more erratic and interest rates were higher than today, but the empire prospered: economic growth not only nurtured private wealth, but significantly improved the standard of living of the general population. Life expectancy rose, child mortality dropped, and the public enjoyed the spoils of an increasingly global economy.

Ostensibly, a rising empire utilised the immense technological progress of the industrial revolution. Upon closer inspection though, the pace of expansion hinged on two factors that not only outlasted the empire but indeed accelerated following its demise: population growth and labour productivity. Now, both are beginning to slow.

Popular demand

In a modern economy, a growing population is invaluable. Rising consumption leads to higher income and, ultimately, enhanced economic growth. In the early 1800s, the average woman of childbearing age would give birth to five children in her lifetime, although life expectancy was still around 40 years. By 1950, the fertility rate had fallen but was offset by a significant increase in life expectancy. The world population grew without precedent.

In the near future however, for the first time in recorded human history, the global population is likely to peak. Dramatically improved living standards pushed life expectancy past 80 years, but progress is naturally diminishing. Simultaneously, fertility is falling below the crucial replacement rate of 2.1 children per woman in developed countries. Estimates for the timing and magnitude of the global population peak vary, but researchers agree that it will happen in this century.

Productivity perils

To offset the effects of a smaller labour pool, resources must be used more efficiently. Indeed, the acceleration of technological advance over the past few hundred years has truly been colossal, especially in the latter half of the 20th century. The invention of the steam engine and the light bulb were roughly 100 years apart; generations of workers would retire in broadly the same technological paradigm in which they first took up their trade. In comparison, the seven decades following the development of the first computer in the 1950s saw the invention of the space shuttle, internet, smart phones, and, lately, artificial intelligence.

After decades of soaring productivity, we are beginning to see stagnation on a global scale. In developed economies, processes are sophisticated; supply chains optimised. Future technological innovation is naturally unfathomable, and the rise of artificial intelligence may ring in a new era of productivity gains. Nonetheless, in developed economies, a return to the advances of old is unlikely.

Future challenges

In the wake of the financial crisis of 2008, investment returns became detached from real economic growth. The emerging paradigm – a return to less remarkable growth and money supply – does not signal the end of prosperity, innovation, or wealth creation. However, for investors it will become more challenging to identify value and capitalise on it.

- Challenge assumptions: Economic growth has been anything but normal over the past seven decades, and its drivers and impact on asset returns will almost certainly change over the next seven.

- Think quality: As liquidity drains from the system, it becomes even more critical to assess how investment opportunities will fare in the new environment.

- Think global: The nexus of population growth and productivity is the new holy grail. We may be entering the Indian century, or the Nigerian one. It will pay to be flexible and avoid unnecessary restrictions.

Successful investors endure because they constantly re-evaluate their environment, challenge their assumptions and adapt their processes. Flexibility will be key, and active management more important than ever.